What is PropTech?

PropTech is the marriage between property and technology. It can be as simple as listing a property on an online marketplace to as complex as breaking down a multi-story apartment complex into asset-backed tokens and trading them on a virtual exchange. Tech enablement of real estate has been a revolutionary step towards user convenience and asset liquidity, whether the objective is to make capital gains or to own an asset.

Global trends in PropTech

PropTech is not a destination but a journey. There have been three significant waves of revolution in PropTech powered by the pace of technology and its inclusion within real estate. The spectrum ranges as follows:

- PropTech 1.0: PropTech 1.0 ranges roughly from 1982 with the introduction of Personal Computers and the launch of Autodesk.

- PropTech 2.0: The second wave mainly focused on property and portfolio management, mapping, insurance, and IoT.

- PropTech 3.0: PropTech 3.0 involves the introduction of big data, augmented and virtual reality, blockchain-based platforms, as well as 5G technologies etc.

Although real estate was one of the last few industries left majorly untouched by technological progress, the merger between technology and real estate is now in full flow. Globally, PropTech is in its second generation (PropTech 2.0), and, with the growing fame of virtual reality, IoT and cryptocurrencies, it is now heading towards the revolution. Additionally, the world over, the boundaries between fintech (financial technology) and PropTech are increasingly blurring, giving birth to a service-agnostic space called PropFinTech – but that is a topic for later.

Pakistan: A case of exploding Real Estate Demand

Before delving into Pakistan’s PropTech picture, let’s first look at Pakistan’s real estate scene. Currently, Pakistan ranks as the fifth most populous country in the world, with the bulk of its population under the age of 24 (a segment that will aim to become homeowners in the next decade). With explosive urbanization and the increasing trend towards nuclear families, the demand for housing is increasing faster than the supply.

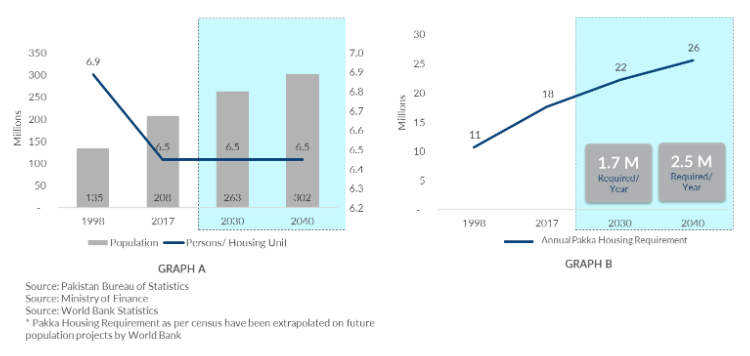

Looking at Graph A, As per the World Bank projections, Pakistan’s population is expected to grow to 302 million by 2040 (shown in the bar chart). However, per the latest census, the persons/ housing unit has fallen to 6.5 people in 2017 (indicated by the blue line). Though the number may experience further decline, even if it remains constant, the annual demand for pukka-constructed houses will total 1.7 million units annually by 2030 (as seen in Graph B). This number will rise to 2.5 million units annually in the next decade.

However, the dilemma lies in access. Despite a burgeoning demand, real estate remains a far-off dream for many and is booked by a select few. Let’s look at the income and savings of the average Pakistani household (pyramid below). Currently, real estate is accessible to only 10% of the population, with average savings of Rs. 628,000 annually, while the remaining 90% remains alienated. Half of the population saves an average of Rs. 30,000 a year, hardly enough to contribute towards a real estate capital gains investment.

In a nutshell, there are inherent pain points in real estate in Pakistan and the world over, which include:

- A lack of access: Real estate is a big ticket item, with property appreciation far exceeding GDP growth and inflation combined, posing a high barrier to entry.

- Information Asymmetry: Ascertaining project cost and determining whether a project has obtained the requisite planning approvals still needs to be discovered. This gives birth to intense speculation and eventual overselling.

- Layer upon layer of intermediaries: The whole ecosystem is rife with middlemen, from agents to lawyers to financial institutes to patwar khanas, all driving up the price tag.

PropTech democratizing Real Estate

With features like asset fractionalization, digital marketplaces and blockchain-based ledgers, the proptech revolution can, with one fell blow, eliminate inefficiencies, empower access and foster financial freedom for investors in the country. PropTech has the potential to not only digitize but democratize real estate, expanding the privilege of homeownership and capital gains from the select few to the middle class.

The human experience is monetized worldwide, and creditworthiness is established based on assets, income and high-ticket possessions. This creditworthiness is the currency that unlocks real estate purchase and/ or development. Unfortunately for Pakistan, this creditworthiness is deteriorating daily with high inflation and an ever-increasing money supply. In essence, the state is eroding the individual’s monetary economic value, making it difficult to purchase or develop the sustainable real estate of good quality, creating vast economic inequalities and substandard infrastructure.

While for the individual investor, PropTech 3.0 can enable asset ownership, on the other end it facilitates developers in raising equity finance by generating credit from within the system in a decentralized way, without the need for any external debt and eventual interest liability.

The bottom line is, with the increasing penetration of technology in our everyday life and the ubiquity of smartphones in Pakistan, the stage is all set for PropTech to solve the housing deficiency and usher in a new breed of property developers.

In Pakistani real estate, PropTech companies have been springing up since the early 2000s. However, most of these companies still fall under the ambit of PropTech 2.0, if not PropTech 1.0. They are usually online marketplaces where agents list property ads (mainly used for rental purposes) rather than a platform where property developers and consumers connect in a transparent ecosystem.

However, the space is slowly heating up as more and more tech-savvy companies are emerging in this space. Startups like DAO PropTech are harnessing technology’s true potential and offering a state-of-the-art technology-based platform that ensures complete transparency and security. On the one DAO, PropTech provides ownership options of diversified properties to the masses. On the other hand, it is raising interest-free capital for developers working on unique real estate use cases.

Future of PropTech

The future of PropTech holds incredible promise:

- AI x Real Estate: With time, the real estate industry is becoming increasingly data-driven by capitalizing on the power of artificial intelligence, machine learning, and big data analytics. These tools can derive powerful insights to create properties customized to modern needs.

- IoT Integration: With the help of Internet-of-Things (IoT), futuristic properties can be controlled remotely and acquire habits learned over time via artificial intelligence programs.

- Digital Ecosystem: The digitization of properties and land records allows access to a global audience. It can also enable cross-border real estate transfer to build greater diversification, impacting global heritage and migration.

- Virtual Tours and Fintech: The introduction of technology also allows ideas that have never been carried out in the real estate sector. Includes virtual tours, no paperwork, and raising finance through crowdfunding and fractional ownership.

The possibilities are endless, but there is still a long way to go for Pakistan to embrace and reap the benefits of PropTech truly. The upside is most of the technologies that the system is built on have already been validated & strength-tested internationally. The need of the hour is the legislation of innovative ownership options in Pakistani real estate and the development of a conducive ecosphere for new startups to flourish and, in doing so, usher in an era of financial freedom for the masses.

To read more blogs, visit our blogs page here.

Esa Imran

Digital & Communications Specialist

Book a Meeting

Book a Meeting