Has anyone ever taught you how to value the real estate you own or the property you’re about to purchase? Did you ever want to sell a property you own but were unsure what price to ask?

After reading this guide, you’ll be able to calculate your property’s value easily.

First, let’s understand the difference between a property’s PRICE and VALUE.

Aren’t price and value the same thing?

No. Simply put, the price is the amount you pay to acquire the property, while value denotes the property’s actual worth.

A deal where the price is less than the value already puts you in profit right out of the gate. Alternatively, you might have made a bad deal if the price you’ve paid is less than the actual value. This is reversed when you’re selling your property.

In the property market, what is often called a ‘valuation’ is the best estimate of the trading price of the property.

THE FIVE VALUATION METHODS:

- Comparison Method

This is the most widely used method in Pakistan. The value of a property is assumed to be at par with similar properties nearby.

How to apply the method

- Select several similar properties in the same vicinity that have recently been sold. The higher the number of similar properties you select, the more accurate your results.

- Since no two properties are precisely identical, adjust the selling price for each comparable element (e.g., size, age, quality, etc.)

- Find the average value of those adjusted property values, and you have your answer.

- Investment Growth Method

This method refers to how the value of a property increases over time. It is mostly used in the following two scenarios:

- When you know the historical value and want to see the property’s current value.

OR

- You know the current value and want to calculate the future value.

How to apply the method

While this looks technical, once you get the hang of it, this is the easiest method of property valuation.

Just use the following formula to calculate your property’s Value

Future Value = Present Value x (1 + Growth Rate)N

where,

Future value = The Value you want to calculate

Present value = The Value you have

Growth Rate = Annual growth rate

N = The number of years

Real estate usually grows at a rate that is the sum of the inflation rate and the GDP growth rate; compound that over your desired number of years, and you have your value.

However, it is essential to remember that this method is only helpful when calculating for durations longer than three years.

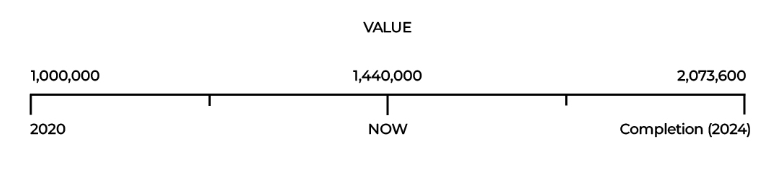

For example, if you had invested PKR 1,000,000 in Elements Residencia at the beginning of the project in 2020, with a growth rate of 20%, your property would be valued at PKR 1,440,000 today (2022). By the time the project is completed in 2024, your property will have doubled in Value to PKR 2,073,600.

- Income Method

The income method approach is particularly common in commercial real estate and rental properties.

How to apply the method

A property is a function of its users and the income it generates. The main idea behind the income approach is to calculate the current value of a property based on the income it generates. Just use the following formula to calculate your rental income or property value.

Annual net income (annual rental) = Property value x Capitalization rate

Roughly estimated Pakistani capitalization rates are as follows:

- Residential: 3%-4%

- Commercial: 4%-6%

- Hospitality: 7%-10%

- High-end residential: 2%-3%

- Industrial: 7%-10%

These rates may still slightly vary depending on several factors such as location, risk level, size, etc. A capitalization rate higher than the market average may be reasonable in rental returns. Still, it may also mean that you are taking on a higher level of risk.

Here, it is also important to note that the “guaranteed monthly rental” promised by some developers before your project is actually completed, is not actually rent, and might be a Ponzi scheme.

- Replacement Cost Method

Simply put, this is the cost you would incur to build the same property today.

How to apply the method

The replacement cost approach uses the formula below:

Replacement Cost = Land Cost + Construction Cost + Design & Overhead Costs + Cost of Equity

Breaking down this formula,

- The Land Cost is the market value of the raw land.

- The Construction Cost is the total cost one would incur to rebuild the ‘new’ building performing the same function.

- The Design & Overhead Costs allow for subjective adjustments relative to the ‘new’ building.

- The Cost of Equity is there to adjust the aforementioned costs for the time value of money (usually using the KIBOR rate).

- Residual Value Method

The residual value approach assesses the market value of the land in redeveloped form. And from this value, we deduct all costs incurred in putting the property into the form commanding that price. This is often the value at which a bank would collateralize your property. This method is also used on older, demolishable buildings where a new project or property is to be constructed.

What do we get from that?

By deducting these costs, a ‘residue’ is produced. This ‘residue’ represents the maximum capital expenditure for buying the land, including all purchase costs (taxation, legal costs, etc.). The net residual land value is then determined by allowing these additional costs.

The best method?

For more accurate results, the best way to use these methods is to apply a weighted average taken from all the valuations of all these methods combined. That will leave you with a range of values, which can then be used to assist all real estate buy/sell decisions.

However, it is essential to remember that these methods only assist you when making informed real estate investment decisions and are not to be solely relied upon.

To read more blogs, visit our blogs page here.

Esa Imran

Digital & Communications Specialist

Book a Meeting

Book a Meeting