Developmental Real Estate in Pakistan: The Biggest Risks

Introduction to Developmental Real estate

The real estate business in Pakistan is worth over $3.5 trillion. It has long been the go-to investment and wealth-generation avenue for most, and for the people of Pakistan, it is no different.

By its very nature, investment in real estate comes with a certain level of risk. Hargitay and Yu (1993) characterised risks as follows:

- The probability of loss

- The probability of the investor not receiving the expected or required rate of return

- The deviation of realisations from expectations

- The variance or volatility of returns

We all take risks day in and day out based on our personal appetites, and it isn’t something we should actively avoid. Instead, it is well known that high rewards come with high risks. The biggest risk is not taking risks. However, knowing the risk you are taking and what returns to expect is crucial. If you are uncertain about the associated risks as well as the returns your investment may yield, you may set yourself up for disappointing losses.

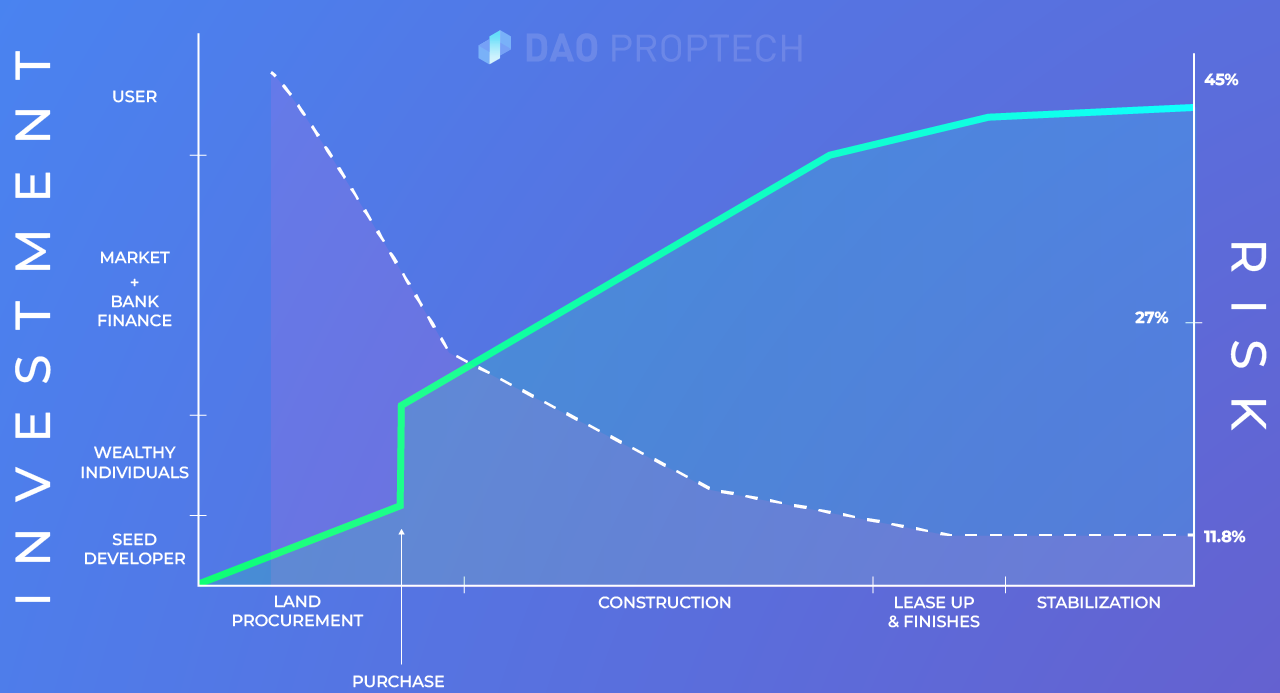

The following graph will help you under the risks and returns involved with a developmental real estate project at different stages of development:

Y-axis

The y-axis on the right, associated with the dotted line of the graph, represents the risk associated with each stage of development. As you can see, the risk is at its highest in the early stages and decreases as the project progresses to completion.

The y-axis on the left, associated with the green line on the graph, represents users that invest in the project at each stage of development.

- Seed developers

- Wealthy Individuals

- Bank/Market Finance

- Users

X-axis

The x-axis on the graph represents a project’s stages of development. A developmental real estate project comprises of four stages:

1. Land Procurement or Pre-Development

This stage pertains to the idea conception, location, feasibility study, project description, developers’ calculations, land assurance, acquiring permits, etc.

2. Construction

This stage includes all the work associated with development, construction, and improvement. It’s the longest stage of a developmental real estate project.

3. Lease up and finishes

At this stage, the project has been completed and is now being leased to users according to the use case of the building.

4. Stabilization

This is the final stage where the building is serving the community according to the use case it provides.

Let’s have a look at the risks involved at different stages of the project

1. Entitlement Risk

There’s the risk of obtaining appropriate land entitlements, construction permits, etc., which is referred to as ‘project approval’ in layman’s term. There are also environmental and design-related risks prevalent at this stage.

2. Construction Risk

In short, wrong estimation of costs due to materials pricing (the risk that the cost of materials may change significantly from the original estimates), opposition by the local community, construction scheduling (the risk that planned construction may prolong due to weather conditions, labour and material delays), etc. are all categorised as construction risks.

3. Lease up / Sales Risk

The risk that forecasted sales will not be realized impacts the pace of construction and the overall health and acceptability of the project. If early termination clauses are invoked, the property becomes encumbered with below-market valuation.

In addition, there’s a risk of significant changes in one or more fixed or variable expense categories such as real estate taxes and the risk that accompanies any ownership of less than 100% due to a myriad of factors regarding control, revenue distribution, etc.

4. Stabilization

Stabilization is the last stage of development and a very crucial one. At this stage, the risk is never eliminated but rather minimized or controlled. For example, there’s the risk that unanticipated competitive supply will enter the market or the risk that rental rates may be negatively affected by changes in market dynamics. The lack of current market data to accurately value the subject property raises a valuation risk at this stage.

In Pakistan, there are numerous malpractices in the real estate industry such as overselling, fraudulent pyramid schemes, slow/non-existent pace of development, lack of data on real estate projects, qabza mafia, hefty agent commissions under the table, pump and dump, etc. Consequently, when investing in real estate traditionally, people in Pakistan unknowingly take high risks due to a lack of transparency, misleading marketing tactics, undeclared over-the-top profits, and more.

How does DAO PropTech’s model help?

DAO PropTech’s founders realised that these mundane practices are now ready for a revolution using data and technology.

DAO PropTech ensures a 100% transparent and secure investing mechanism, with all our transactions posted on a digital ledger, the blockchain – a secure, immutable, and transparent record-keeping system. We also publicly share all legal and regulatory documents to help investors make informed decisions. Our pricing mechanism is transparent and scientifically linked to each stage of development, the risks associated, and without any hidden costs. This allows for maximised returns with no premiums charged – giving the power to the customer.

DAO PropTech has successfully onboarded institutionally qualified real estate projects/use-cases (using a Proprietary Project Selection Matrix, read more here) worth PKR 20 billion onto our first-of-its-kind digital platform, BLOC. Sign up here at daoproptech.com to view.

Ahmad Mahmood Chouhan

Communications and Activations Specialist

Book a Meeting

Book a Meeting